Vendor Deposit Processing

When a user creates a vendor deposit in DesignSmart they will indicate the amount and how it will be paid. They can select from the accounts that have been checked on the Accounts tab, but these will normally be your checking account and one or more credit cards.

When the deposit is pushed from DesignSmart to QuickBooks (Desktop or Online), the amount of the deposit will be:

1.Added to the appropriate account register - the checking account or a credit card account

2.If the payment method is check, you will need to print the check and send it to the vendor

3.At the same time the Other Current Asset account that you selected in the Defaults Items Tab, will be credited this amount.

In other words, the money you send to vendors will be considered an asset on your balance sheet. This is the inverse of how clients deposits are considered a liability on your balance sheet.

Paying the Vendor Bill Balance

When you receive a vendor bill and it reflects the deposit you have already paid, then you will need to indicate enter that deposit when you enter the vendor bill.

This will move the money out of the Other Current Asset account and into an expense account.

Step 1 Enter the vendor bill as you normally would.

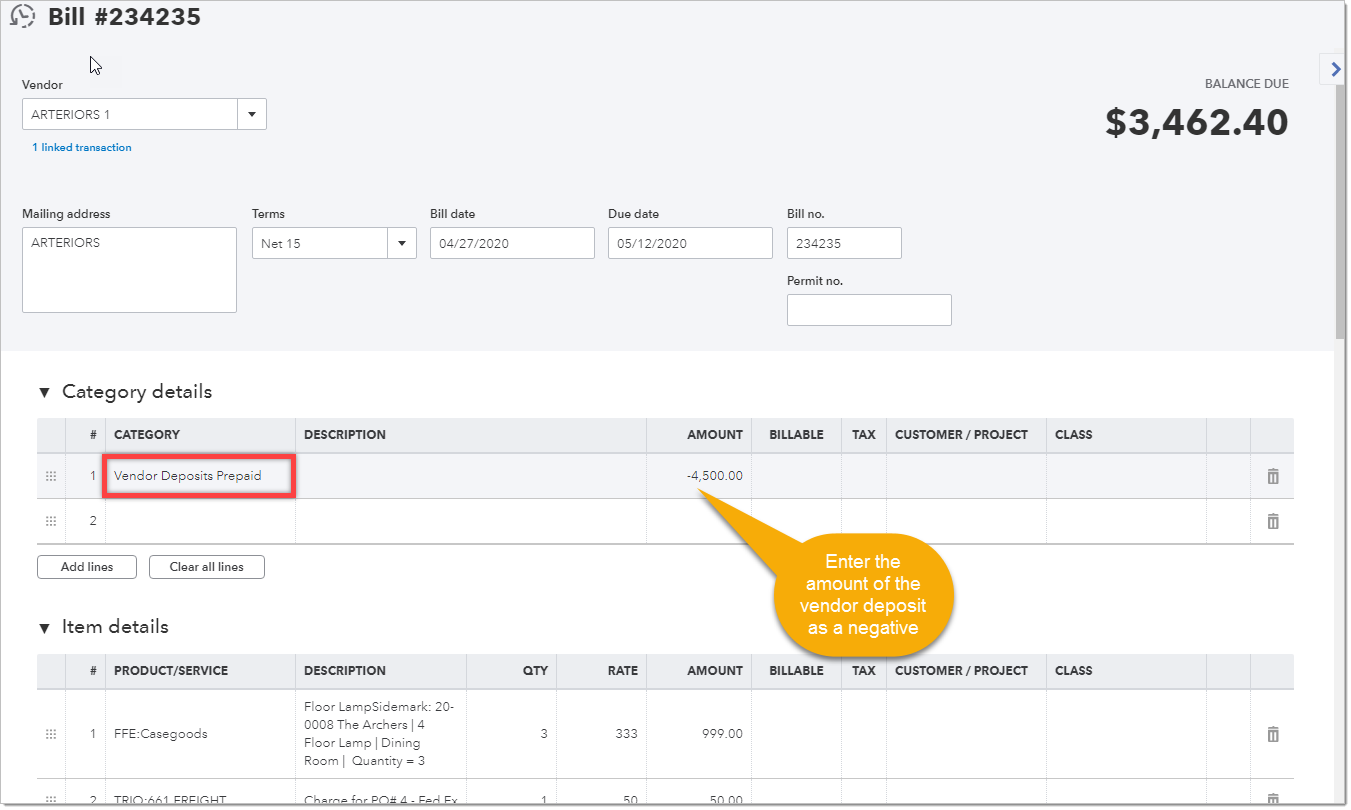

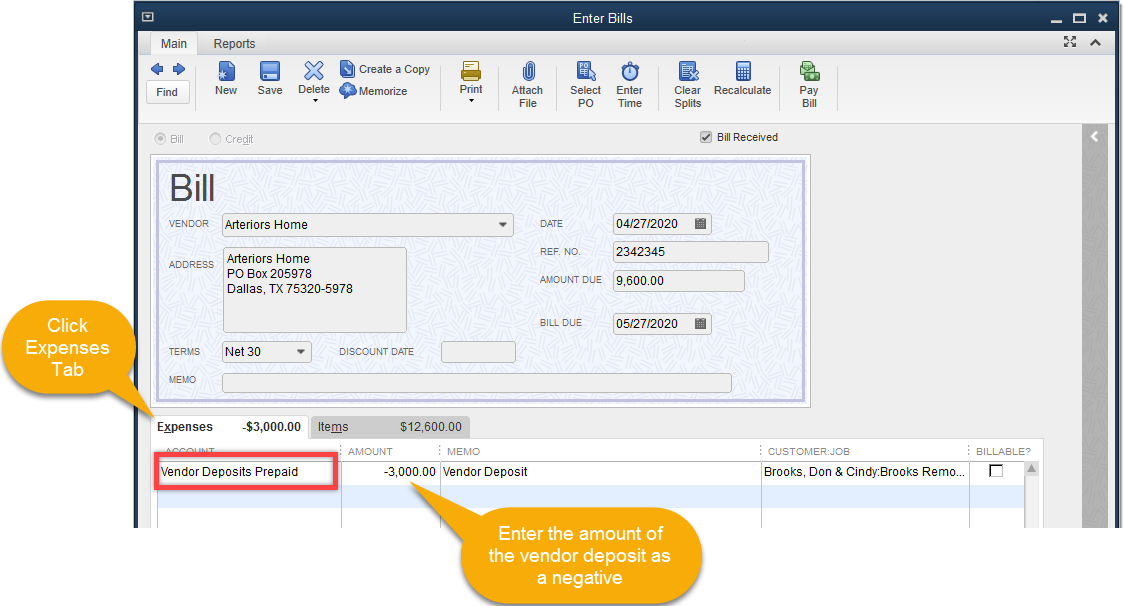

Step 2 Click on the Expenses tab (QB Desktop) or on the Categories tab (QB Online).

Step 3 Select the Other Current Asset account used to record vendor deposits.

Step 4 Enter the amount of the deposit preceded with a negative sign.

Applying the vendor deposit to a client bill in QuickBooks desktop

Applying the vendor deposit to a client bill in QuickBooks Online