Normally if an item is taxable the markup is taxable so DesignSmart will send to the invoice in QuickBooks the total of the cost and markup. So if a chair costs your firm $100 and you mark it up $50, then DesignSmart will send to the invoice in QBooks a line for the chair for $150 and flag it as taxable.

Or sometimes an item might be non-taxable and the state tax laws state that the markup on those items, or services, is not taxable. For example, if your cost for freight is $50 and you mark it up $10, then DesignSmart will send to the invoice in QBooks a line for the freight for $60 and flag it as non-taxable.

But what if the item and markup for that item have different tax statuses?

Markup for Taxable Items

We recommend that your firm set up an item in QuickBooks called something like, "Markup Taxable". Depending on your state's sales tax rules, this item might not be required, but we recommend going ahead and setting it up. The reason this item is when you have the following scenario:

Suppose that the sub-charge "Freight" is not taxable, but the markup you apply to freight is. When you create the invoice for the freight the following will need to happen:

1.In this case, DesignSmart will send to QuickBooks a line for the freight using the QB item "Freight" which in this example we have said is not taxable.

2.Now DesignSmart will also need to send in a line to QuickBooks for the markup and it will need to use the "Markup Taxable" item for this. This line will be marked in QBooks as taxable.

Markup for Non-Taxable Items

While the logic for requiring a "Markup Taxable" is reasonable, the logic for needing a "Markup NonTaxable" item in QBooks seems a bit odd, but we have had at least one client require it.

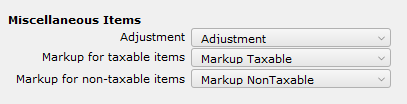

Here is the scenario for needing this item in QBooks and set up as in the image above:

Suppose that the sub-charge "Freight" is taxable, but the markup you apply to freight is not. When you create the invoice for the freight the following will need to happen:

1.In this case, DesignSmart will send to QuickBooks a line for the freight using the QB item "Freight" which in this example we have said is taxable.

2.Now DesignSmart will also need to send in a line to QuickBooks for the markup and it will need to use the "Markup NonTaxable" item for this.