How to Issue Credits

When clients return items, you can use the create a credit for the returned item(s). There are four simple steps required to do this.

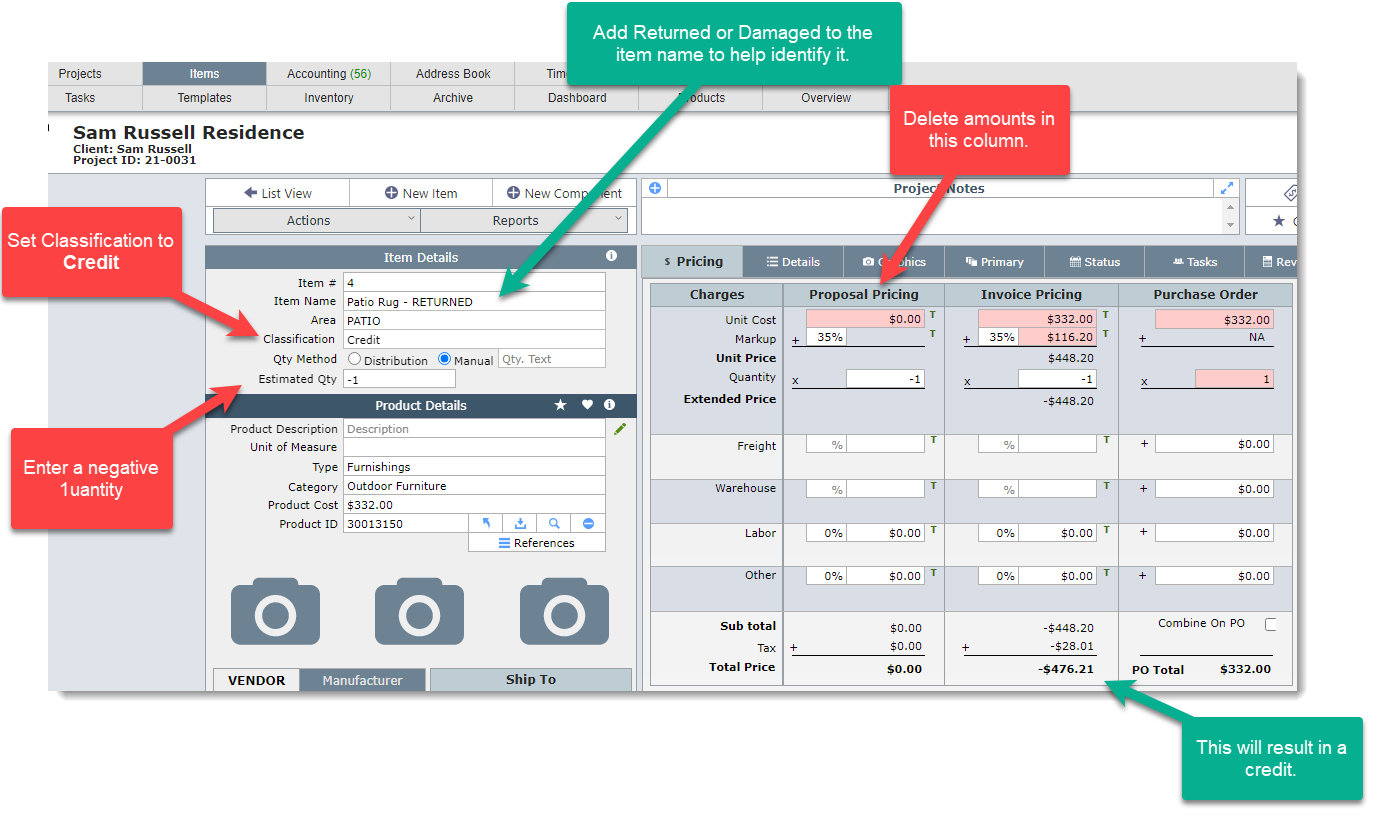

1. Create a new item for each item being returned. Add the word "Returned" or "Damaged" or something descriptive to the item name.

2. Set the Classification to Credit

3. Enter a negative quantity

4. Remove the amounts in the Proposal Pricing column. This will keep your reports accurate.

What Happens Next?

1. If you create an invoice with only returned items, the total amount of the invoice will be negative. This means when the invoice is sent to QuickBooks it will create a Credit Memo for this amount. How you process the credit memo is up to your firm. You might apply it to future invoices or refund the client this amount.

2. If you add these credit items to an invoice that has noncredit items, then one of two things will happen. If the noncredit items you are charing for exceed the amount of the credit items, then the invoice sent to QuickBooks will be a regular invoice with a balance due. On the other hand, if the amount of the credit(s) exceed the amount of the items you are invoicing for, then when this invoice is sent to QuickBooks it will result in a Credit Memo.